Tuesday, April 01, 2025

Description: The scams in this tracker are based on consumer complaints. They represent descriptions of losses incurred in transactions that complainants have identified as part of a fraudulent or deceptive operation; we have successfully recovered funds for clients. Payback verified the losses reported by complainants. As new scams emerge, Payback will update this list on an ongoing basis to alert and protect the public. If you hear about a scam that is not listed here, please let us know by submitting a complaint.

Advance Fee Scam – Scammer requests an upfront payment, promising a future service or huge return on investment.

Affinity Scams – Scammer targets members of an identifiable group (e.g., cultural, religious, or ethnic community) and curries favor with them to rope them into a fraudulent investment opportunity.

AI Investment Scam – An investment scam that involves the promise of high returns on investments through the use of a “proprietary” AI system or automated trading bot.

Bait and Switch Scams – A scam to mislead buyers, whereby a seller advertises an appealing but ingenuine offer to sell a financial product or service that the seller does not actually intend to sell. Instead, the seller offers a sub-par, defective, or unwanted product or service. For crypto, this might be most relevant to non-fungible tokens.

Bitcoin Mining Scam – A scam that involves the promotion of a fraudulent investment opportunity related to bitcoin mining. This involves a scammer soliciting an investment opportunity involving the development of a bitcoin mining operation. Scammers will typical purport that invested funds will go into developing the infrastructure necessary to run a bitcoin mining operation (e.g. hardware GPUs, servers, etc.), and that investors will earn a portion of the proceeds from the rewards associated with successfully mining bitcoin.

Crypto Blackmail Scam – Scammer sends emails or physical mails to victims saying they have personal information about the victim or embarrassing or compromising photos or videos. They scammer then threatens to make these things personal information public unless the victim pays them in cryptocurrency.

Crypto Gaming Scam – Scam involving the use of fake gaming applications (apps) with the intent of stealing crypto from victims. Scammers may advertise the apps as play-to-earn games offering financial incentives for players, but will typically require victims to create a cryptocurrency wallet within platform to participate in the game. Victims may be incentivized to deposit additional crypto for in-game rewards and may be misled into thinking they are accumulating rewards through their participation in the game. At a certain point, the scammers may drain victim wallets using malicious programs victims unknowingly activated upon joining the game.

Crypto Job Scam – Scammers impersonate recruiters and offer fake job opportunities with the intent to steal crypto assets and personal information. These opportunities typically offer questionable terms that are too good to be true and may promise monetary rewards or bonuses for completing certain tasks from the comfort of your desk. However these tasks are assigned with the intent of deceive victims to send crypto assets and/or personal information.

Crypto Wallet Drainer Attack – Crypto Wallet Drainers Attacks are a subset of Hacking through the use of a type of malware known as a crypto wallet drainer. Crypto wallet drainers are tools that scammers can use to automate the draining of crypto assets from a victim’s cryptocurrency wallet while the victim is interacting with a malicious website posing as a website for cryptocurrency projects or trading.

The risk of being exploited by a malware attack extends beyond interacting with obscure or speculative cryptocurrency projects and applies to any online engagement with unusual websites that may be malicious. DFPI recommends consumers to exercise caution when interacting with the platforms of lesser-known cryptocurrency projects that are more speculative in nature. In addition, DFPI also cautions consumers to check the domain names when accessing websites of well-known cryptocurrency projects to ensure they are not interacting with an imposter website.

Fraudulent Trading Platform – Scammer develops a fraudulent website or application and convinces victims to deposit funds to the platform under the guise of providing victims access to a unique investment opportunity. The fraudulent platforms appear legitimate, even going as far as replicating price movements and producing artificial gains.

Hacking – Exploiting a computer system or private network inside a computer with the intent of stealing personal information, such as passwords and bank account information, for financial gain.

High Yield Investment Programs (HYIP) – Ponzi schemes that promise passive income and high returns in short periods of time through an investment of crypto assets. These schemes often offer payment structures similar to that of multi-level marketing or pyramid schemes to recruit new investors, promising early investors a percentage of the profits of other investors they recruit. These schemes are usually heavily promoted through social media and may use paid social media promoters to market their product. Initially, the investment platform will appear legitimate and produce positive returns on a consistent basis. However, scammer will eventually take off with the invested funds and freeze the platform under the guise of technical issues, before completing shutting down the platform.

Identity Theft – Crime in which someone wrongfully obtains and uses another person’s personal data in some way that involves fraud or deception, typically for economic gain (Aka identity fraud).

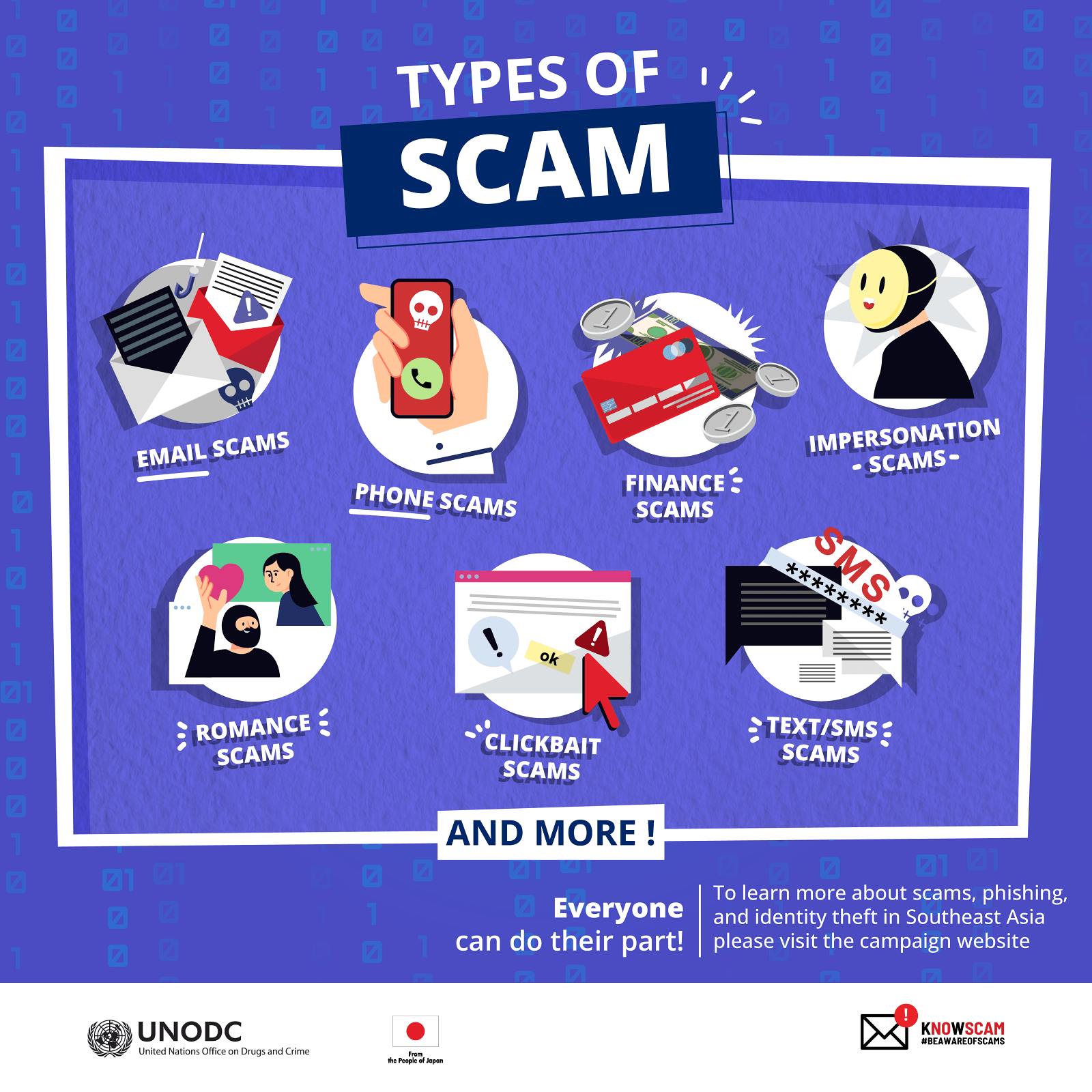

Imposter Scams – Scammer impersonates a legitimate business, government agent, or well-known figure to gain access to a user’s systems and personal information for financial gain (e.g. to steal the user’s assets).

Investment Group Scam – A scam that involves the use of private messaging rooms/group chats (WhatsApp, Telegram, etc.) to promote a fraudulent investment opportunity. In some cases, victims may be targeted individually by an agent of the scam through social media and coerced into being brought into the group. In others, victims are directly added into an investment group chat. Many times the group chats are led by a “guru” who directs the group followed by an assistant that acts as a second-in-command. Guru’s may be impersonating a well-known public figure or may be falsely portraying themselves as registered professionals. Early on, the guru may give general market advice to to gain the group’s confidence and then push group to trade based on their directions. Agents of the scam may also be in the group chat masquerading as fellow investors using fake accounts or use bots to inflate the number of perceived investors in the group chat.

Liquidity Mining/Yield Farming Scam – Liquidity mining/Yield Farming is an investment strategy used to earn passive income with crypto assets. Investors stake their crypto assets in a decentralized exchange (DEX) or other form of liquidity pool to provide traders with the liquidity to conduct transactions on the platform. In exchange, investors earn rewards in the form of interest, governance tokens, or other rewards. In a liquidity mining/yield farming scam, victims move cryptocurrency from their wallets to the liquidity mining platform and see the purported returns on a falsified dashboard. Believing their investments to be a success, victims purchase additional cryptocurrency. Scammers ultimately move all stored cryptocurrency and investments made to a scammer-controlled wallet.

Crypto Giveaway/Airdrop Scam – Scammer will compromise or impersonate a prominent public figure (e.g. through AI-created deepfakes) or company and claim to give away free crypto and may use a variety of methods to promote the giveaway such as livestream events, promotion on social media, or offering airdrops on a certain website or platform. However, these promotions typically offer questionable terms that are too good to be true and may either an attempt to elicit payment of crypto assets or may be part of a broader phishing scheme designed to access victim’s private keys, wallet address, and/or other sensitive information.

Pig Butchering Scams – Scammer may use a variety of methods to establish a relationship (either social, romantic, or business focus), and then gain the victim’s confidence and gradually introduce the victim to a fraudulent investment opportunity. In most cases, Scammer will approach victims through social media or dating apps, ask to take the conversation offline (e.g., Whatsapp, WeChat), and then communicate regularly with the victim to establish the relationship. Once Scammer has the victim’s trust, Scammer will then propose an investment opportunity related to crypto assets. Scammer will offer to train the victim to set up an account on an exchange to purchase crypto assets, and then provide a website or wallet address for the victim to transfer funds in order to participate in the investment opportunity. The fraudulent platform investment opportunity is often designed to appear legitimate, and often produces artificial gains to keep the victim engaged in the platform and possibly deposit more funds. However, the victim is never able to withdraw their funds from the site, and may be asked to transfer even more funds before anything can be withdrawn through a variety of excuses (e.g., service fees, IRS taxes, etc.).

Ransomware – Scammer gains access to a victim’s computer systems or private network, encrypts sensitive information or data, and demands a ransom from the victim to restore access to the encrypted information or data upon payment. Scammer will then provide detailed instructions on how to pay the fee to get the decryption key and may accept payment in crypto assets.

Romance or Social Media Scam – Scammer adopts a fake online profile to gain a victim’s affection and trust and then uses the illusion of a romantic or close relationship to manipulate and/or steal from the victim.

Rug Pull Scam – Derived from the expression “pulling the rug out”. Variation of investment scheme where a developer attracts investors to a new cryptocurrency project (e.g., a new token or initial coin offering) through online crowdfunding, pumps up the value of the investment, and then pulls out before the project is built, leaving investors with a worthless currency.

Signal Selling Scam – Scammer offer systems or software that claim to provide accurate and profitable trading signals through some sort of proprietary insider knowledge, secret strategies, or automated systems that can lead to significant profits. However, when coupled with the use of a fraudulent trading platform, these trade signals may be completely fabricated and may be used to gain the victim’s confidence and keep them engaged with the fraudulent trading platform.

Tech Support Scam – Tech support scammers want victims to believe they have a serious problem with their computer, like a virus. They want victims to pay for tech support services the victims don’t need, to fix a problem that doesn’t exist. They often ask victims to pay by wiring money, putting money on a gift card, prepaid card or cash reload card, or using a money transfer app because they know those types of payments can be hard to reverse.